Cloudilic is a leading provider of advanced AI solutions for the fintech industry. We use state-of-the-art machine learning and deep learning techniques to create innovative products and services that enhance the financial experience for customers and businesses. Our solutions can help fintech companies improve customer satisfaction, reduce operational costs, increase revenue, and comply with regulations.

Some of the AI solutions we offer for the fintech industry are:

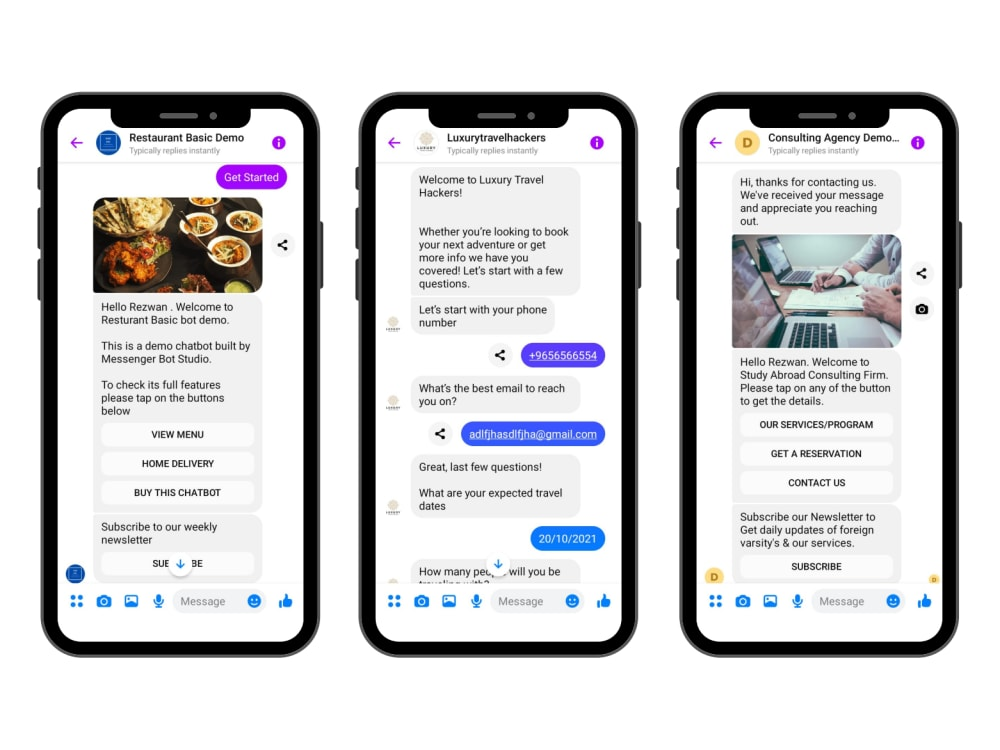

Chatbots and digital assistants:

We use AI to create chatbots and digital assistants that can interact with customers via voice or text, providing them with personalized financial advice, support, and guidance. Our chatbots and digital assistants can also handle transactions, payments, transfers, and other tasks, simplifying the customer journey and increasing loyalty. For example, we have created a chatbot that can help customers manage their personal finances, savings, and investments.

Robo-advisors:

We use AI to create robo-advisors that can provide automated financial planning and investment management services to customers. Our robo-advisors can analyze the customer’s financial goals, risk profile, preferences, and behaviour, and suggest the best portfolio allocation and strategy for them. Our robo-advisors can also monitor the market conditions and adjust the portfolio accordingly, optimizing the returns and minimizing the losses. For example, we have created a robo-advisor that can help customers invest in cryptocurrencies.

Fraud detection and prevention:

We use AI to detect and prevent fraud and cyberattacks in the fintech industry. Our AI system can analyze large and complex data sets from various sources, such as transactions, devices, locations, biometrics, and behavior patterns, and identify any anomalies or suspicious activities. Our AI system can also alert the relevant parties, block the fraudulent transactions, and take corrective actions. For example, we have developed an AI system that can help fintech companies prevent identity theft, money laundering, and phishing.

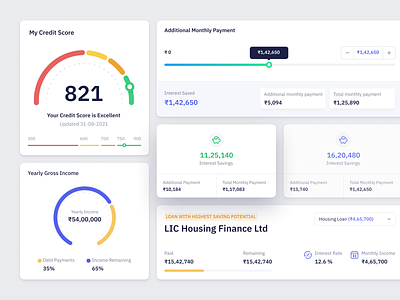

Credit scoring:

We use AI to create credit scoring models that can assess the creditworthiness of customers using alternative data sources, such as social media posts, online behavior, e-commerce purchases, and other factors. Our credit scoring models can provide more accurate and fair predictions of the customer’s ability and willingness to repay their loans, as well as their default risk. Our credit scoring models can also help fintech companies expand their customer base by reaching out to underserved or unbanked segments of the population. For example, we have created a credit scoring model that can help fintech companies lend to small businesses in emerging markets.

These are just some of the examples of how we use AI to revolutionize fintech. We are constantly innovating and developing new solutions to meet the needs and challenges of this dynamic and disruptive industry.

Contact Us

If you are interested in our chatbot solutions or have any questions or feedback, please feel free to contact us at [email protected] or call us at +46 736 975 017. We would love to hear from you and help you create your own chatbot solution. Thank you for choosing Cloudilic.